7 Urgent Reasons to Buy Gold Now

July 1st, 2015

Don't Get Caught Unprepared!

1. Rule #1 of investing in assets: Never fail to buy an asset below its replacement value!

Gold is priced near its average cost of production and below its margin cost of production! The cost of gold production has boomed. Many mines’ incremental cost of production is well above $1,300 and the average is said to be $1,200. To be diversified, an investor should have at least 20 percent of their portfolio in hard assets like gold. Many people are poorly diversified, and often when they look back they discover that they had too much in paper assets and not enough in tangible, real assets. 2. Wall Street is under pressure amid ongoing Greek crisis. The Greek debt drama, which first started in early 2010, is coming to a head now as Greek Prime Minister Alexis Tsipras has called for a popular referendum on the latest bailout proposal from the European establishment and the International Monetary Fund, throwing the country's position within the Eurozone into jeopardy. Banks in Greece were also shut down on Monday (June 29th) as officials struggled to prevent the country’s financial system from collapsing. Wise investors are drawing closer to Gold's defensive, safety-havenfunctionality. Physical gold is private, portable, secure and immutably valuable. Historically, it has retained its value, maintaining through the collapse of governments and even cultures. No paper asset offers the same security.Gold’s safety haven appeal often benefits from uncertainty in the wider financial markets.

3. Turmoil has rocked bond and currency markets, and options traders forecast equity swings that reach levels not seen in a year. Many are bracing for major disturbances in the immediate future. The same issues that cause other investments to fall make the price of Gold rise. This is why diversifying your portfolio to include Gold makes sense. Gold is insurance for your portfolio, adding stability and balance. 4. Margin debt is blowing up in the market. According to NYSE, margin debt has risen to an all-time high of more than $476 billion. Similar spikes immediately preceded the 2000 dot-com bust as well as the financial crisis of 2007-8. History has shown that Gold tends to outperform other mainstream investments in times of economic troubles. Gold remains not only a store of value but continues to show its ability to increase in worth while protecting personal assets 5. Economic unrest is being exacerbated ever-increasing tensions all over the world. As ISIS inches closer to Baghdad, there are growing demands for U.S. troop deployment. Furthermore, China's Communist -controlled Global Times recently warned that war with the U.S. is inevitable if the U.S. continues its demand that China halt construction on Mischief Island near the Philippine's Palawan Island. Custody of the island is in dispute. In addition, nuclear armament concerns surrounding Iran and South Korea raise legitimate fears for what will happen in the future. These concerns have affected the price of gold and will continue to do so. Through all the turmoil, Gold remains a safe haven asset. Although gold may be perceived as volatile in the short term, throughout history it has maintained its value over time. The precious metal historically outperforms other investments during times of political unrest.

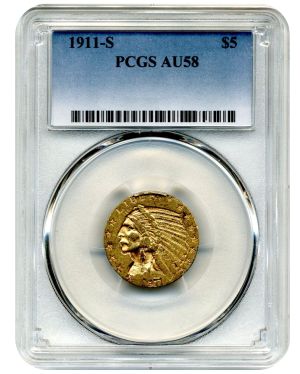

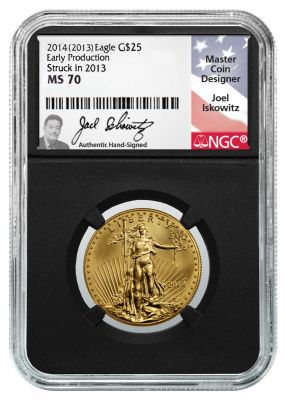

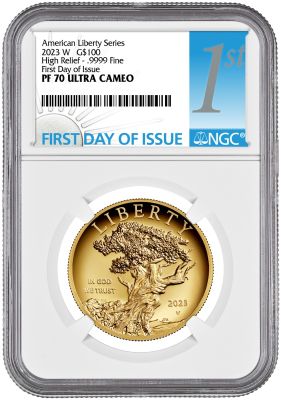

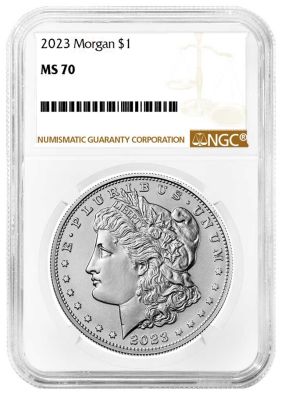

6. U.S. & Russian military tensions raise fears of a new Cold War. The U.S. is poised to send some of its most advanced warplanes to Europe in a clear message of force aimed at Russian President Vladimir Putin. Meanwhile, Putin has announced that he is adding 40 intercontinental missiles to his country's nuclear arsenal. The conflict between U.S. and Russia is escalating. Both sides profess that real war is not imminent. However, the rhetoric and hostile activity from Russia has definitely turned up in recent days and weeks, raising concerns of a new arms race -- if not worse -- amid tensions both sides blame on each other. 7. U.S. debt is up from $13 trillion to $18 trillion in just the past five years. This paints a bleak picture for investors. Worldwide instability such as rising government indebtedness makes Gold a safer investment. Erstwhile Fed chair Alan Greenspan advises that Gold is a good place to put money now, given it's “value as a currency outside of the policies conducted by governments.” The time to buy Gold is now! U.S. stocks are long due for a correction and equities are losing ground. Inflation remains a serious threat to savings accounts and our looming debt crisis makes the outlook for the dollar grim. These factors make the investment in physical Gold not only a smart thing to do, but an urgent necessity. Call an IPM Account representative today and build a strong and diverse metals portfolio that can help protect you in these uncertain times. About International Precious Metals Since 1995, International Precious Metals has grown to become one of the largest and most recognized nationwide dealers of U.S. Mint coins, and a leader in rare historic U.S. Gold and Silver. Visit www.preciousmetals.com for more information.