Guide to Passing Down Your Coin Collection to Heirs

Coin collecting is a fun way of viewing different types of numismatic art and engaging with ancient history. To numismatists who are passionate about coin collection, deciding to turn your valuable coin collection into an investment that you can pass down to your heirs is very sentimental. Here is a guide to pursue numismatics as a fun hobby and a lucrative mode of investment to you and your heirs.

Brief History of Coin Collecting

In the 1800s, when American Numismatic Society started preserving medals and coins, middle-class individuals began collecting US and UK coins. More and more coin collectors developed an interest in coin collecting and started researching about the history of America's founding Fathers and their connection to early colonial coins.

In the 1900s, coin collectors shifted their focus towards the mint mark of precious coins so as to know where their coins had been minted. Today, there are millions of coin collectors across the United States who are passionate about finding and investing in these hard-to-find, valuable coins. Today, numismatic coins with exceptional value or history are a valuable investment that can be passed down to the next generation as heirlooms.

Why Coin Collections Are Valuable

The two principal sources that define the value of coins are:

The physical metal or bullion value: This is the intrinsic value of coins usually derived from precious metals that the coin is made of, such as silver and gold. In order to know the bullion value of a particular coin, you should multiply the prevailing coin's spot price per ounce by the ounces of that metal.

Collector or numismatic value: A coin's collector or numismatic value is dependent on the buyer's sentiment and is quite hard to determine compared to bullion value. In most cases, the numismatic value of a coin applies to rare or antique coins and are often controlled by the law of supply and demand. Furthermore, a coin's current physical condition matters a lot when determining the numismatic value of a particular coin.

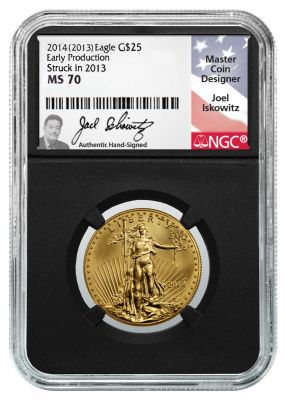

It's advisable to focus on the bullion value of a coin when you start building your portfolio. Even though investing in antique or rare coins tends to be more profitable, gauging the dynamics of the collector market a few years into the future can be confusing to first-timers. Therefore, investing in modern bullions coins such as the American Gold Eagles that contains excellent, high-grade precious metals is a more sound approach.

The numismatic appeal of modern coins is considered more handsome than that of older coins by most collectors. This means that there is a numismatic value involved in determining the value of a coin even if it's an old coin with a good store of bullion value.

For example, pre-1965 American quarters and dimes contain 90% silver and are usually valued by collectors due to their precious metal content. When you order a mixed package of junk silver coins, you end with silver metal pieces and simultaneously fill out the dates that are missing in your coin collections.

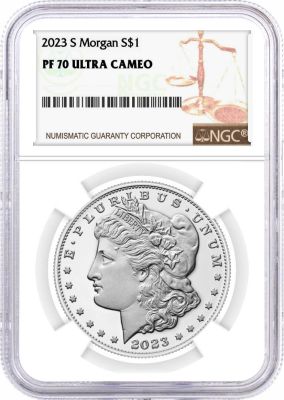

On the other hand, some precious coin collections such as the American silver dollars are great for building a numismatic investment and a bullion investment at the same time. That is why some coin collectors have built coin collection portfolios that include common coins with less collector value but selling for prices that are higher than their bullion values.

While such coins are not the best for someone who wants to grow his/her coin collection profile, they're a prized possession you can pass down to your kids.

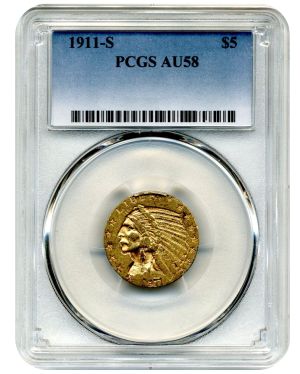

Moreover, if you love or appreciate the historical value appeal of numismatics, this category of older coins can be a valuable bag of inherited coin collections. Even the pre-1933 gold coins, which have higher bullion values than silver coins, also fall into this category.

There are certain coins that are mostly considered to be the best numismatic investments. The scarcity of the coin, which determines its collector value, is factored in when determining its value and thus controlling its bullion value. Therefore, if you intend to invest in precious metals or coins primarily for their numismatic appeal, it's crucial to choose coins that most collectors are eyeing.

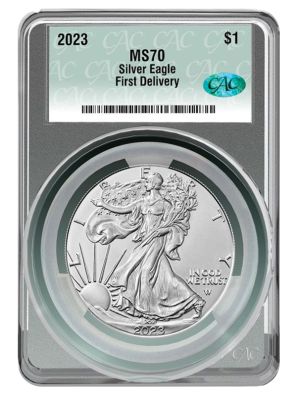

The main factors that affect the numismatic value of a coin are its mint marks and rare dates. Hence, it's important to ensure the coin is certified so as to avoid rare minting errors, especially if you're interested in the numismatic value of the coin. A certified coin is one that has been professionally inspected and graded by an accredited body and then kept under the safe hands of a protective organization or holder.

Contrary to popular belief, you don't have to spend thousands of dollars in a precious coin in order to get the highest numismatic value for your coin collection. For instance, the 1950-D Jefferson nickel is one of the most affordable pieces for collectors on a budget. It's inexpensive because of its mint mark and key date pairing.

Leaving A Coin Collection To Your Heirs

Passing down a coin collection to your heirs carries a financial value and can hold sentimental value to your children, especially if one or more of your adult children has a special interest in coin collection.

Transferring part or all of your coin collections to your heirs can be a daunting decision if you're worried about disputes breaking out among family members or close friends when the will is read. Breaking up your carefully developed collection to avoid these disputes can be a tough choice. To ensure that the heirloom doesn't bring issues and that your investment is well passed down, there are a few things you should do.

- Write down clear instructions

You can decide to pass down your collection to one person who is capable of treasuring it by following your written instructions or guidelines on how to store and protect your valued coin collections. For instance, your heirs should know that your coin collection should be stored in clean, climate-controlled environments and should not be touched with bare hands.

- Tell a story

Clearly write down your intentions in your last official will to ensure everyone is aware of your final wishes. This is to ensure that a coin collection that you personally valued is respected and well-protected after you're gone. That is why it's important to write down the stories you have about each of your coins regardless of whether your heirs are coin enthusiasts or collectors themselves.

Your memoirs should include anecdotes about the collection's history, the coins' provenance, and why you started the collection itself. Make the memory even more attractive to your loved ones by shooting a video of yourself talking about the collection.

Remember, the coin collection is part of your life, and the years of enthusiasm you experienced as a passionate coin collector. Therefore, dealing with an established valuable online coin dealer who can guide you in making the right decisions and developing the value of your coin collection further is a good idea.

- Identify the right heirs

It's crucial to know who among your family members or close is enthusiastic about coin collection. While some of your heirs may prefer to inherit in the coin collection, others may prefer cash.

So, to avoid hard feelings down the road, you need to know where each of your heirs' interests belongs. This is one way of identifying the best-suited steward if you want the collection to be passed down to your grandchildren.

Decide whether you want to parcel out some of the coins now or wait for a few years. Deciding to hold on to the coin collection until your demise is a totally different story altogether.

Your decision will largely depend on the living arrangements of your heirs. For instance, some of your heirs might be too engrossed in their work-related commitments and not be able to create room for your valuable coin collection even if they love it.

Giving away the coin collection before you die allows you to bask in the joy of seeing your loved coins bestowed now. Passing down a user manual to your loved one, for example, on how to take care of the collection, is a rewarding experience. You can have your coin collection appraised, but allow your heirs to choose what they love from your collection based on interest, not the coins' value.

- Handle all the logistics

When you leave your coin collection to your heirs, special tax and estate laws will apply. Even though these laws are not the same as the other laws that govern the process of distributing other estate assets, you should observe them strictly. Failure to abide by these laws may result in market value depreciation of the assets, high income or estate tax penalties, and unnecessary capital gains taxes to your heirs.

In addition, liquidating the rare coin collection where the worth of the individual coins is predominantly derived from sentimental family value can also be troubling. That is why large coin collections often complicate an otherwise straightforward distribution of one's assets.

Furthermore, some family members or friends may have different opinions about the fair market value of the collection left behind. All these differences and troubles may cause serious disagreements among heirs, or lead to costly litigations.

It's therefore, advisable to ensure you obtain appraisals for your coin collection while you're still living. You should also keep records of insurance coverages, date, price, and damages on each of the coins in your collection.

To Wrap It Up

Passing down your coin collection to heirs is one of the most precious and emotional things to do in life. However. the process of inheriting coins and turning them into a rewarding investment with sentimental value can be challenging.

International Precious Metals (IPM) is one of the leading online coin dealers with over 20 years of experience in numismatics. If you're looking for a premier online coin dealer to be your trustworthy partner in buying and selling your precious metals, contact us today. Our experts will also give you professional guidance on the do and don'ts when dealing with inherited coin collections.