Why Are Precious Metals Falling

Let's Put it in Perspective: Are Precious Metals Prices Really Falling?

Though precious metals dropped in price near the end of last year, the value of precious metals is still significantly higher than it was 15 years ago. Last year, the Federal Reserve announced plans to raise inflation rates this coming spring, which had an immediate negative effect on precious metals prices.

But the Reserve announced in December of last year that they could be “patient in beginning to normalize the stance of monetary policy” which saw precious metal prices rebound by an average of 1.1 percent. The combination of a dovish Fed and ongoing uncertainty in the markets is projected to give precious metals some lift. And though mining investments are doing poorly, there is still enormous global demand for physical gold and silver in India and China. And sales at the U.S. Mint are at an all time high.

Then What Caused the Recent Drop?

In response to the dollar's advance to a five-year high in early November of last year, about $1.66 billion was erased from the value of precious metals holdings. The dollar climbed in response to the new Republican Senate and steps taken by the Bank of Japan to

Gold and silver fell to four-year lows, with December delivery for gold slipping 1.9 percent, the lowest since April of 2010. December delivery for silver dropped 3.2 percent, the lowest since February of 2010. Palladium dropped 4.1 percent and Platinum fell 12 percent over last year.

Another factor in the drop was the announcement by The Federal Reserve to raise interest rates this coming spring, at a time when other central banks were working to stimulate their economies

Overall, there was a drop in precious-metals holdings from 97.4 billion in March of 2014 to $76 billion in November.

Is This An Opportunity for Investment?

The demand for gold, silver, platinum and palladium will rise and fall over time. But precious metals remain a solid investment and an excellent way to diversify your portfolio. Precious Metals offer protection against inflation because, historically, gold, silver and

Precious metals offer a slow but steady increase in value. They are tangible and supplies are finite endowing them with inherent value and they aren't subject to the same forces as stocks and other paper assets. Also, when you buy with cash, your ownership of physical precious metals is completely private. Because you are in possession of the metals, your portfolio does not need to be accounted for the government, banks or financial institutions. These metals are extremely liquid assets that remain safe from the factors that threaten other investment types.

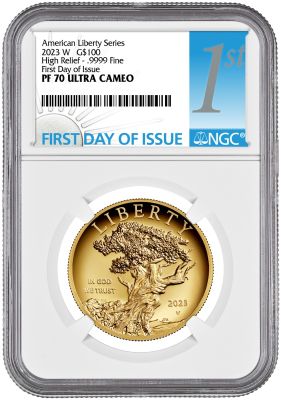

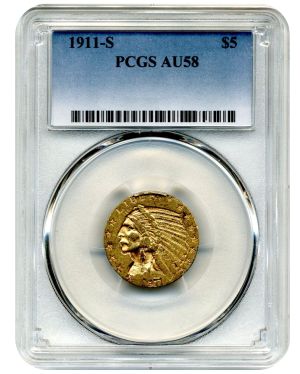

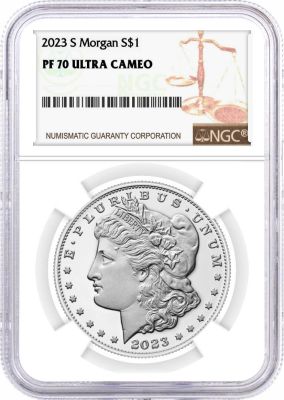

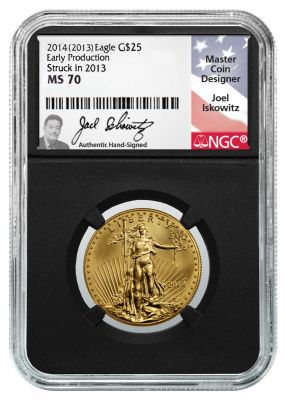

Examples of Secure, Long Term Investments

The

American Gold Eagles are an excellent way to diversify the types of metal in your portfolio. The coins have historically provided a hedge against inflation. The U.S. Mint Catalog lists the American Eagle 2014 One-Ounce Silver Proof coin as one of its best selling products. Minted at West Point, it is made from one ounce of .999 fine silver.

Another top seller is the American Eagle 2014 One-Ounce Silver Uncirculated coin minted at West Point as well. On October 20, the Mint released the American Eagle 2014 One-Ounce Platinum Proof - the sixth and final coin of the series - minted at West Point.

About the Author

Call now 800-781-2090

Tags