Rare Coin Market & Their Worth

The Rare Coin Market in 2020: Understanding A Rare Coins Worth

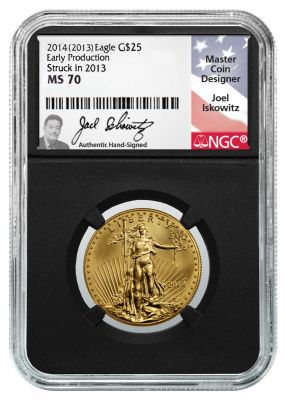

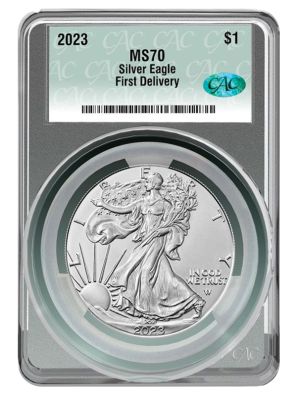

As the stock market’s bull run continues in 2020, investors are looking to find ways to diversify their holdings and the rare coin market has been an answer to many. The popularity of holding on rare coins as investments has skyrocketed in 2020, due to the similarity the market shares with vintage items. However, a key difference is that the rare coin market has a rock-solid infrastructure of auctions and graders that keep the market liquid and reliable.

The Value of Rare Coins

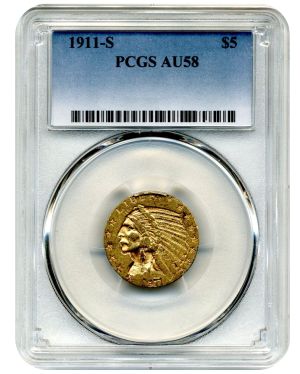

It’s no secret that the rare coin market is complex. The value of a coin is directly linked to its condition, which is described by a condition or grade. However, as time progresses, the number of coins in excellent condition will inevitably decrease. If an investor were to hold onto a rare and valuable coin in superb condition and keep it safe, then it’s value will rise over time as other similar coins get lost or damaged over time.

Supply and demand

A keen investor would recognize that supply and demand are king in the market – and the rare coin market is no exception. More investors are pouring into the rare coin market every day, but the stock of rare coins is not growing at nearly the same rate. Demand is beginning to outstrip supply – finding new coins is not common nor is it easy. However, even without the influx of new blood, the rare coin market has performed exceptionally well.

The Value of Rare Coins

The Gold Dollar

A commonly traded coin is the Gold Dollar coin, which was being minted between 1849 and 1889. The graph above shows how the price for the coin has changed over time for a specific grade the coin – AU55, which stands for “About Uncirculated,” meaning the coin is in very good condition. From 2004 to 2017, it’s clear that the price of this coin has increased dramatically, growing from $180 a coin at auction to almost $380. In percentage terms, that’s over a 110% growth over thirteen years, which beats out S&P 500 performance by a significant margin (~35% vs. 110% growth).

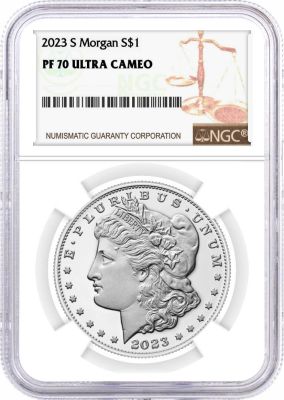

The more affordable Silver Dollar

A more affordable coin for investors to try their hand with is the Silver Dollar coin. The graph above outlines the change in price for Silver Dollar coins minted in 2012. It’s clear that the coin had a small dip after it was first released, but the coin displays similar behavior that the Golden Dollar (chart above) had shown when the coin was first released. Over a longer span of time, the coin has jumped from about $76 a coin to over $100, marking a gain of over 30% in value in just four years. The silver dollar is a prime example of an affordable coin to trade – it’s easy to find at auctions and the entry price isn’t prohibitive. The charts above demonstrate that trading rare coins is generally a long term strategy, as the price trend upwards over time. The 2004 Golden Dollar is a discontinued coin, and it’s quite clear that it’s value has steadily appreciated over the past decade.

The Growing Worth & Value of the Rare Coin

What happens to the value of a coin if it’s no longer being produced, but holds legendary status for collectors? There exist coins that are so rare that only a handful remain and avid coin collectors are dead-set on adding them to their collection. One such example is the Fugio Cent – the first-ever penny created by America, and the rarity in mint condition coins means that perfectly preserved specimen will only increase in value over time. In fact, it could be reasoned that these coins will always be a safe investment, as the extremely limited quantity means that it will only ever increase in price as time progresses and other such coins get damaged or lost. By holding a coin as the Fugio cent, the price will steadily increase over the years due to the lack of supply, but the ever-increasing demand. In fact, there is a record of a Fugio Cent coin that sold for $94,000 in March 2015, but was purchased for $35,250 just under two years prior in July 2013 – more than a 165% increase in under two years.

The Growing Worth & Value of the Rare Coin

Over the past few years, the rare coin market has become recognized as a niche asset class that has performed very well. While initial impressions may make rare coin investing seem like collecting baseball cards, it becomes clear that the rare coin market is much more developed – it possesses a rock-solid infrastructure and has thousands of auctions that make the market more liquid. In addition, the varying price points of rare coins can allow any investor to enter in the market and amass a collection of rare coins that can outperform the S&P 500 year-over-year. Nothing in the stock market is guaranteed, but the past performance of rare coins and huge inflow of new investors means that demand is far outstripping supply – and it’s an excellent idea now to join the market before prices rise even more.

If you’re interested in buying rare coins, explore the collection at IPM here. Feel free to learn more about unique coins and precious metals by checking out our blog posts, too including What Exactly Are Modern Coins, What is Numismatic Value, & Is Gold A Good Investment.